The conversation of sustainability and conscious consumption has finally reached the doorsteps of fashion consumers. They are beginning to ask important questions like “How much waste does the fashion industry generate?” (read our previous blog) and “Where does the fashion industry’s waste end up?”. These are closely followed by “Well then, why isn’t the waste being recycled?”. All these questions are perfectly valid questions to ask, the answers though are laden with complexities and not quite straight forward.

What happens to the fashion industry’s waste?

Today we will be shedding some light on the question: “What happens to the fashion industry’s waste?” We will be sharing some of our findings that we gathered over six years of research across Europe, Asia and parts of North Africa. We were able to map out different types of waste streams that get generated, factors that determine their further treatment, the value they garner from the recycling industry and most importantly, the obstacles that make recycling exceptionally difficult.

In the present day scenario, there are primarily three factors that dictate the way in which a waste stream gets treated or managed:

a) the type of waste

b) the composition of the waste (e.g. 100% cotton vs cotton-elastane blends),

c) the volume of similar materials merged together (100 kg vs 3 tonnes generated in one location changes things a lot)

Decoding waste types

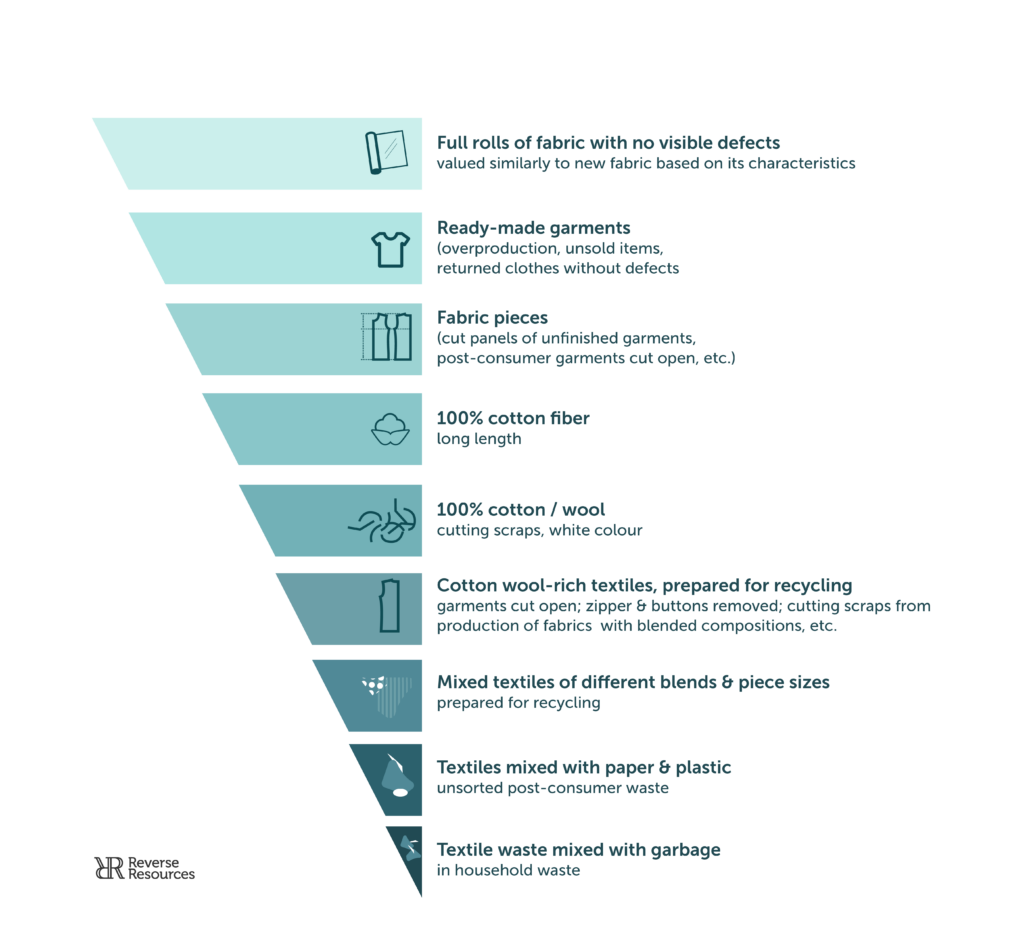

Now that we have laid out the factors that determine the treatment of the waste, let us start by decoding the first factor- ‘the type of waste’. It is important for us to relook at how we categorize fashion industry’s waste. Instead of categorizing them as pre- and post-consumer waste, let us assign more granular categories to it such as the following.

Textile waste based on value

We can now create a hierarchy of these categories of waste streams based on their ‘value’. And by ‘value’ we hereby mean if a waste stream or category still carries the potential of being used as raw material for something else. The hierarchy would look something like this:

(This list could be significantly longer if we tried to include all aspects and looked into the various characteristics of the textiles. For the purpose of this article, we have just included all of them together.)

On this hierarchy, one can place a line to identify where the economic value begins to go negative. When doing so, the complications of geographical location and volume come to play. In most countries, the line can be placed somewhere in the middle of the ready-made garments category. From below the line onwards, the value drops to zero.

In Europe, for example, there are few countries that attach a positive value to a large range of textile waste than others. For example, in Germany and Poland waste is extensively collected and prepared for recycling. There are also countries like Spain and Italy that have long traditions of textile recycling. These countries, given their capabilities, are able to absorb massive volumes of waste from other countries for further processing and recycling. But here the ‘composition of the waste’ plays a crucial role. The recycling efforts in these countries give preference only to wool and cotton. With the majority of textile waste being composed of blended materials, the lower end of the hierarchy either gets incinerated or ends up in landfill; a situation that the European countries are eagerly hoping to address and change.

The scenario is rather different in other parts of the world. For instance, India and Turkey have large fashion production hubs and fairly well-developed recycling eco-systems for their industrial waste streams. Recycling becomes easier with ‘large volumes of the same kind of textile waste streams’- the third factor that determines treatment possibilities.

In India, Turkey and China, textile waste is heavily used in many different industries (like automotive, furniture, construction etc) and product ranges like rugs, blankets, car seats, furniture stuffings etc. China stopped imports of post-consumer, while India continues to be one of the biggest importers of used textiles from other countries. At the same time the local collection of used textiles is far from a well-functioning system.

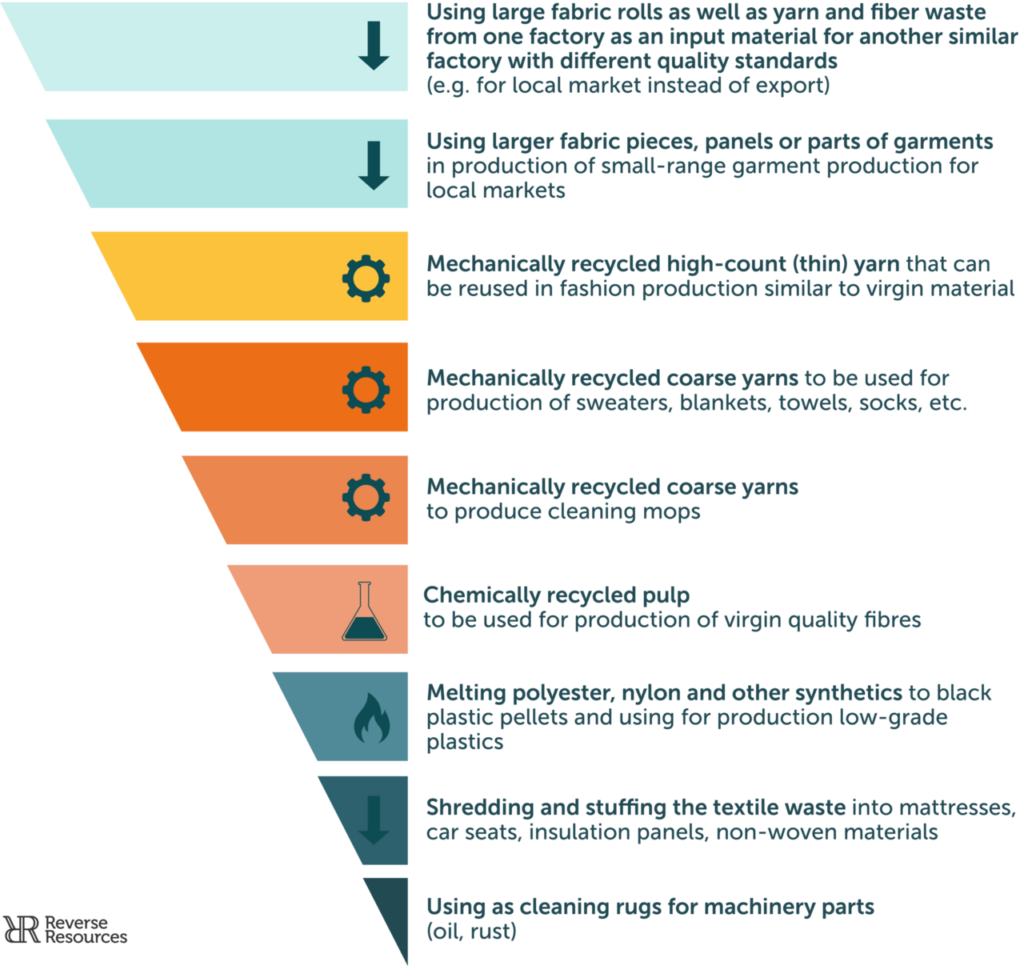

Textile waste based on use case

Interestingly, based on the different use cases of the textile waste in India, we can create yet another hierarchy. One that ranks the waste streams by the lifecycle of the product made out of them and even further, the number of life-cycles this fibre could have later on. This hierarchy would look like this:

As we go up this hierarchy, recyclers gets more sensitive and particular about the waste stream type, quality and composition that can be used as raw material by them. However, in reality, other factors step in and redefine the market value of the waste streams, despite their potential to reach the highest level of recycling.

Problems with unregulated textile waste market

The current arrangement of the waste streams’ position in the hierarchy and thereby the value they can procure, has been entirely left up to the market to regulate. Issues like mismatch of geographical locations, market barriers (lack of information, political power games, etc.), lack of efficient supply chains (that can collect or sort large volumes of similar materials) and economies of scale weigh in during this market regulation. Due to this, large volumes of textile waste end up getting pushed to the lower end of the hierarchy and get combined with mixed waste. These then either get used to make products with only a single lifecycle or get incinerated. In the absence of this market regulation, the waste would have naturally flowed into the lower levels of the hierarchy, and would have demanded less steps to be taken in the entire value chain.

These are just some of the many complexities that not just make textile waste recycling extremely difficult but also infeasible. By the time the waste navigates numerous hurdles and reaches the recycler as raw material, its price point is considerably high. This then gets pushed onto the prices of recyclers’ end products as well. When these products get back out in the market they have to compete with the incredibly low price points of products made out of virgin materials. For textile recycling to scale up, the price of the recycled material needs to be lower than that of their virgin alternative. Today, only cotton has achieved this stage in the market. For other materials (polyester, other synthetics and blends) the list of challenges is much longer and finding the feasibility is much tougher.

Initiatives within the fashion industry to bring down market barriers

It is often stated that “only 1% of textile-to-textile recycling is done globally”. The validity of this statistic is questionable, nevertheless we can say, fairly certainly, that the world could in fact recycle 85% of all its textiles and textile waste today. The technological advances that have been made, over the past few years, are in fact capable of taking on the recycling of complex textile compositions. The limitations that different textile recycling technologies are actually facing are significantly less related to technology than to a number of other market barriers. And so the most herculean task still remains- “getting the waste to reach the right place in a feasible way”.

One way this could be addressed is if the public sector were to intervene. But given the boundaries of individual countries and regions, bringing about systemic change by the public sector seems improbable as well. Alternatively, we can build collaboration within the fashion industry itself – globally, to create the change and make the public interest heard from inside the fashion system. This is why we initiated the Circular Fashion Partnership – to voice the need to bring down market barriers for textile waste to be able to reach recyclers efficiently and on scale.